The best cities in India to set up a Global Capability Center (GCC) are those that combine deep talent pools, reliable infrastructure, strong industry ecosystems, and competitive costs. India offers multiple mature and emerging hubs where global firms can build scalable, high-impact GCCs that support technology, finance, analytics, and operations. This guide walks through the key selection criteria for establishing global capability centres , profiles the top and emerging cities, and explains how talent and ease of doing business shape your GCC location strategy.

Make your scaling decision easier and hire a GCC team with flexiple vetted experts seamless onboarding guaranteed quality.

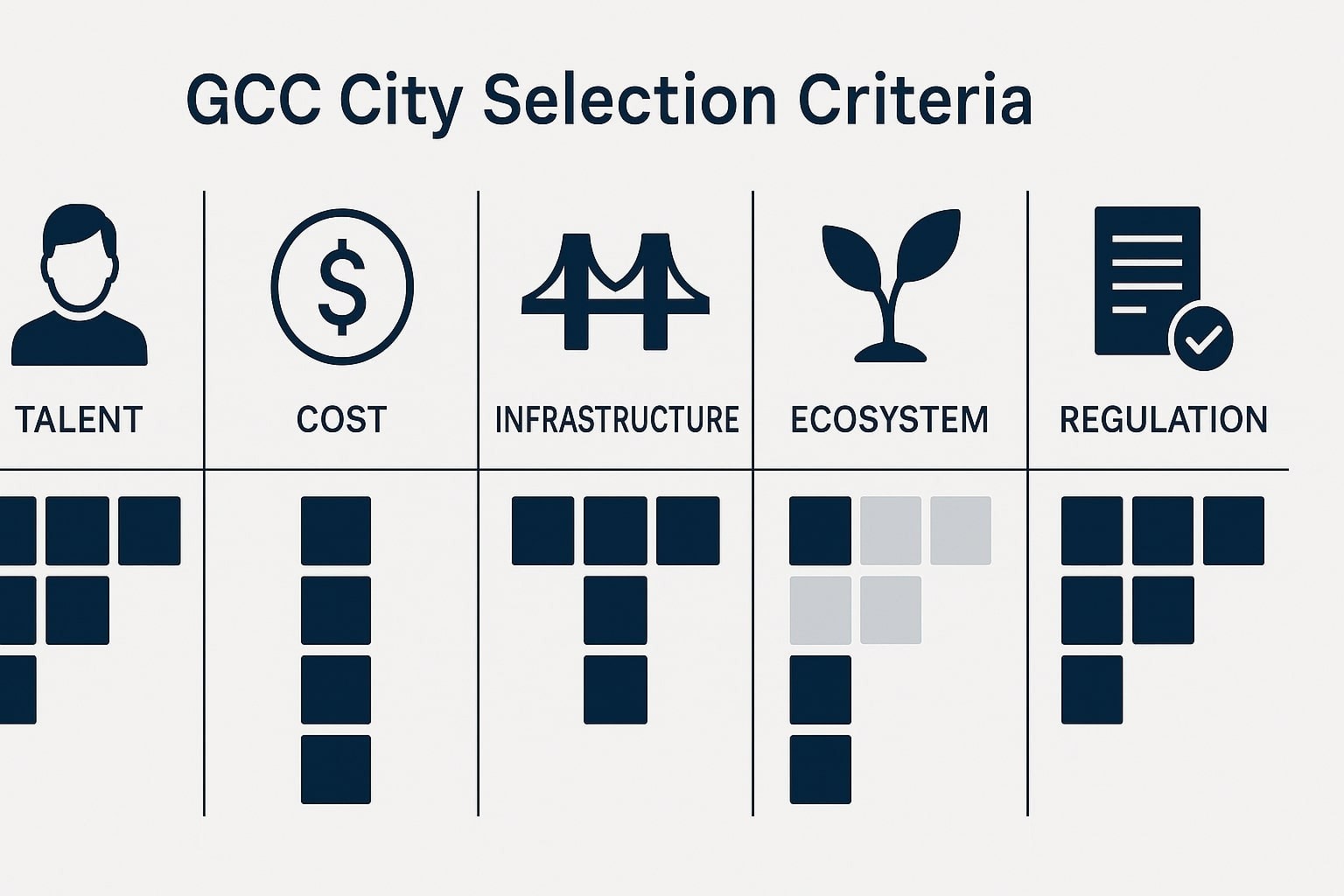

Criteria for Selecting the Best City for a GCC in India

Criteria for selecting the best city for a GCC in India focus on talent, infrastructure, costs, business environment, and ecosystem maturity. A structured checklist helps you compare cities objectively based on operational efficiency instead of choosing based only on brand perception.

Talent Depth and Skill Relevance

Talent depth and skill relevance are the first filters for any GCC location. You should assess the availability of engineers, finance professionals, data analysts, operations specialists, or other profiles you need over a 5–7 year horizon. Look at local universities, existing GCC presence, and competing employers to understand both supply and competition for talent.

Infrastructure, Connectivity, and City Livability

Infrastructure and connectivity determine how smoothly your GCC operates day to day. Evaluate quality of office parks, public transport, airports, power reliability, and digital connectivity, along with housing and amenities for employees to ensure world class infrastructure . Cities with strong social infrastructure and livability scores help you attract and retain senior leaders and specialized talent.

Cost of Operations and Wage Levels

Cost of operations directly affects the GCC business case. You should compare wage levels for key roles, commercial real-estate costs, recurring expenses such as transport, facilities, and local taxes to determine lower operational costs. The goal is to balance cost advantages with talent quality rather than just choosing the cheapest city.

Ecosystem Maturity and Industry Clusters

Ecosystem maturity shows how ready a city is to support GCC growth. A strong ecosystem includes other GCCs, technology and consulting firms, recruitment agencies, training partners, and startup activity. Industry clusters—such as BFSI, automotive, or telecom—also matter if you want domain-specific talent and partners.

Regulatory Environment and Ease of Doing Business

Regulatory environment and ease of doing business influence how quickly you can set up and scale. Consider local state policies on IT/ITES, investment incentives, labor rules, and approvals for strong government support . Cities with dedicated IT corridors and proactive government agencies usually offer faster setup and smoother ongoing operations.

Top 6 Cities In India to Set Up GCC

The top 6 cities in India to set up GCCs are Bengaluru, Hyderabad, Pune, Chennai, Delhi NCR, and Mumbai. Each city offers a distinct mix of industry strengths, talent depth, and cost profile, allowing you to match your GCC vision with the right location.

Bengaluru: India’s Leading GCC Destination

Bengaluru is India’s leading GCC destination because of its massive technology talent pool and mature ecosystem. The city hosts hundreds of global captives across software, product engineering, fintech, retail, automotive, and advanced analytics. Access to senior engineering leaders, product managers, and startup-style talent makes Bengaluru ideal for high-value digital and innovation work.

From an ecosystem standpoint, Bengaluru offers world-class IT parks, a dense network of service providers, and strong collaboration with startups and academia. However, high competition for skilled talent and rising salaries mean you must differentiate with culture, work, and career paths. For GCCs focused on advanced engineering, platform builds, AI, and global product ownership, Bengaluru remains the benchmark location.

Many leaders benchmark their choices using the list of global capability centers in Bengaluru as a reference.

Hyderabad: Fastest-Growing GCC Hub

Hyderabad is the fastest-growing GCC hub in India, combining deep tech talent with relatively moderate costs. Large global firms across cloud, enterprise software, healthcare, and financial services have built substantial engineering and operations centers here, driving digital transformation . The city’s planned IT corridors, good physical infrastructure, and reputation for safety and livability attract both fresh graduates and experienced professionals.

Hyderabad’s ecosystem is supported by proactive state policies, availability of Grade-A office space, and strong local universities. Compared with Bengaluru, competition for talent is slightly lower, making hiring and retention more predictable for new entrants. For companies seeking a balanced mix of cost, scale, and stability, Hyderabad is an excellent choice for a primary or secondary GCC.

Hyderabad’s growth story stands out among global capability centers in Hyderabad, making it a top choice for capability expansion.

Pune: Strong Engineering and BFSI GCC Ecosystem

Pune offers a strong engineering and BFSI-focused GCC ecosystem. The city has a long history in manufacturing and automotive, which has evolved into capabilities in embedded systems, engineering R&D, and industrial software. It also hosts several global banks and financial firms running technology, risk, and operations centers.

Pune’s talent pool is fed by engineering colleges and universities in and around the city, along with professionals relocating from Mumbai and elsewhere. Costs are generally lower than Mumbai and slightly lower than the most premium micro-markets in Bengaluru. If your GCC strategy prioritizes cost efficiency and combines product engineering with BFSI, automotive, or industrial domains, Pune gives you a good blend of skills and affordability.

Chennai: IT, R&D, and Automotive GCC Strengths

Chennai stands out for its mix of IT services, R&D, and automotive strengths. The city has deep capabilities in application development, infrastructure management, and shared services for global enterprises. At the same time, automotive OEMs and suppliers have built significant engineering and design centers here, creating a strong industrial R&D cluster.

Chennai’s workforce is known for stability and relatively lower attrition compared with some other metros. Infrastructure in IT corridors like OMR has improved significantly, though commuting can still be a consideration in certain areas. For GCCs that seek strategic partners focused on long-term, operations-heavy work or engineering for automotive and industrial sectors, Chennai is a compelling base.

Delhi NCR (Gurugram & Noida): Consulting and BFSI GCC Powerhouse

Delhi NCR—particularly Gurugram and Noida—is a powerhouse for consulting, BFSI, and diversified corporate GCCs. Many global consulting, research, and knowledge services centers operate here, along with banks, insurers, and diversified conglomerates. The region offers strong analytical, consulting, and corporate support talent, including finance, legal, HR, and procurement.

Gurugram is known for premium office spaces, access to senior corporate talent, and proximity to decision-makers in India’s capital. Noida provides competitive costs with solid infrastructure and is especially attractive for large campuses. For GCCs that need consulting-style skills, corporate functions, and multi-business support, Delhi NCR offers a powerful combination of capabilities.

Mumbai: Financial Services and Corporate GCC Hub

Mumbai is India’s financial capital and a natural hub for financial services and corporate GCCs. Global banks, insurers, asset managers, and rating agencies run key technology, risk, and analytics functions out of the city. Corporate headquarters, investment firms, and media companies also build specialized GCC teams here for strategic and high-sensitivity work.

While wage and real-estate costs are higher than many other cities, Mumbai’s strength lies in its deep domain talent and proximity to regulators, clients, and partners. The city is particularly suited for front-office-adjacent functions, high-end analytics, treasury, and critical corporate roles that benefit from being close to India’s financial ecosystem. Many firms combine Mumbai for niche teams with lower-cost cities like Pune, Hyderabad, or Chennai to enhance global competitiveness for large-scale operations.

Emerging Cities for GCCs in India

Emerging cities for GCCs in India provide additional options for diversification, cost optimization, and niche skills. They are best suited as secondary locations or specialized hubs that complement larger metro centers.

Tier-2 Tech and Services Hubs

Tier-2 tech and services hubs are gaining momentum as companies look beyond the largest metros. Cities such as Coimbatore, Kochi, Ahmedabad, and Jaipur are building capabilities in IT, shared services, and back-office operations. They offer lower costs, shorter commutes, and strong regional talent pools, especially for operations and support roles.

Specialized Industrial and R&D Locations

Some emerging cities stand out for domain-specific strengths rather than general-purpose IT. For example, locations with strong manufacturing, automotive, or energy clusters can host GCC teams focused on plant digitization, engineering R&D, and supply chain analytics. These centers usually work in close partnership with both global headquarters and local plants or partners.

When to Choose an Emerging City for Your GCC

Choosing an emerging city makes sense when you want cost advantages and are willing to invest in building local capabilities. It is usually better to start with a mature metro, prove the GCC model, and then expand into emerging locations for specific functions. You should also ensure that leadership roles remain connected to major hubs to maintain business continuity and avoid isolation of teams in smaller cities.

The overall landscape described in global capability centers in India helps refine city-level selection decisions.

Talent Availability in India for GCCs

Talent availability in India for GCCs is one of the country’s biggest advantages for global companies. India provides both volume and variety of skills across technology, finance, analytics, design, and operations, supported by robust digital infrastructure .

Engineering, Digital, and Product Talent

India’s engineering and digital talent underpins many global GCC strategies. Cities like Bengaluru, Hyderabad, Pune, and Chennai together host large populations of software developers, data engineers, cloud specialists, and product managers. This talent supports end-to-end work, from platform builds and modernization to AI, cybersecurity, and DevOps.

BFSI, Consulting, and Knowledge Services Talent

BFSI, consulting, and knowledge services talent is concentrated in Delhi NCR, Mumbai, and Pune, with a meaningful presence in other cities. These roles include investment analysts, risk specialists, actuaries, research professionals, and corporate finance experts. GCCs use this talent to run global research centers, decision-support hubs, and managed services for business units worldwide.

Operations, Customer Experience, and Shared Services Talent

Operations and customer experience teams draw on India’s long history in BPO and shared services. Across major cities, you can find experienced talent in customer support, finance operations, HR services, procurement, and supply chain operations. This workforce is comfortable working in global time zones and following structured processes and SLAs.

University Ecosystem and Future Talent Pipeline

India’s university ecosystem provides a strong future talent pipeline for GCCs. Engineering colleges, management institutes, and specialized schools for design, data, and law feed fresh graduates into entry-level GCC roles. Collaborating with campuses through internships, projects, and training partnerships helps you build a steady stream of early-career talent.

Ease of Doing Business for GCCs in India

Ease of doing business for GCCs in India is shaped by national reforms and state-level initiatives. Most major GCC cities offer dedicated IT corridors, infrastructure support, and policies designed to attract global investment.

Regulatory and Policy Support

Regulatory and policy support for IT and GCCs has improved significantly in recent years. Central and state governments provide frameworks for IT/ITES units, special economic zones, and technology parks that simplify approvals. Many states offer incentives on stamp duty, power tariffs, or training for eligible projects, especially when they create jobs in priority sectors.

Infrastructure and Real-Estate Readiness

Infrastructure readiness reduces time from decision to operational launch. Established GCC cities have a plentiful supply of Grade-A office spaces, plug-and-play tech parks, and reliable connectivity. Working with experienced developers and facility partners allows you to scale from a pilot team to large floorplates without major disruption.

Availability of Local Partners and Service Providers

Local partners and service providers make it easier to handle HR, payroll, legal, and facilities. In mature GCC cities, you can find specialized recruitment firms, legal advisors, tax consultants, training companies, and managed office providers. This ecosystem lets your internal team focus on strategy and governance while partners manage local execution.

Practical Considerations for Foreign Companies

Foreign companies setting up GCCs in India should plan for some practical considerations. These include understanding entity structures, banking and forex processes, data transfer rules, and visa requirements for expatriate staff. Engaging local counsel, global accounting firms, and relocation partners early ensures a smoother setup and ongoing compliance.

FAQs About the Best Cities to Set Up a GCC in India

1. Which Indian city is best overall for setting up a GCC?

Bengaluru is often considered the best overall city for setting up a GCC because of its deep tech talent and mature ecosystem. However, the “best” city for you depends on your primary functions, industry, and cost appetite. Hyderabad, Pune, Chennai, Delhi NCR, and Mumbai may offer a better fit if your focus is BFSI, consulting, shared services, or domain-specific work.

2. How should we choose between Bengaluru and Hyderabad?

You should choose between Bengaluru and Hyderabad based on talent needs, cost, and competition. Bengaluru offers the deepest pool of senior product and engineering talent but has higher competition and wage pressures. Hyderabad balances strong technology talent with relatively lower costs and is attractive if you want scale with more predictable hiring and retention.

3. Is it necessary to have multiple GCC locations in India?

It is not mandatory to have multiple locations, but many mature GCCs eventually adopt a multi-city strategy. They often use one metro as the primary digital or leadership hub and add secondary cities for specific functions or cost optimization. This approach improves resilience, spreads hiring risk, and helps you tap into different talent clusters.

4. Are emerging cities a good starting point for a new GCC?

Emerging cities are usually better as a second step rather than the starting point. New GCCs benefit from the ecosystem, leadership depth, and experience of established metros during the build phase. Once your model stabilizes, you can extend operations to emerging cities for targeted functions, lower costs, or regional diversification.

5. How far in advance should we plan our GCC location strategy?

You should plan your GCC location strategy with at least a 3–5 year view. This horizon lets you account for future headcount, skills, cost trends, and policy changes, not just immediate needs. A thoughtful, long-term location strategy helps you avoid frequent shifts and makes your GCC an enduring strategic asset.